a new era for speed and streaming

Formula One has officially joined the tech-streaming race. On October 17, 2025, Apple Inc. and Formula One Group announced a landmark five-year agreement granting Apple TV exclusive U.S. broadcast rights for all Grand Prix weekends starting with the 2026 season.

The deal, reportedly valued at around $140 million per year, replaces ESPN’s expiring contract and marks F1’s most significant U.S. media shake-up in decades. For the next half-decade, Apple TV will be the only place where American fans can stream every practice, qualifying session, sprint, and race — a seismic shift for both motorsport and streaming television.

from cable to cloud

This move is part of a much broader trend: live sports abandoning linear TV for digital ecosystems. Just as Apple TV’s Major League Soccer “Season Pass” transformed soccer’s streaming model, this new F1 partnership aims to reimagine how audiences experience motorsport.

According to Sports Business Journal, the deal encompasses all U.S. broadcast rights, including digital distribution and highlights. Apple will offer “select practice sessions and a limited number of races free-to-watch” via its TV app, but full-season access will require a subscription to Apple TV + or a dedicated F1 Pass tier.

While neither party disclosed specific financial terms, insiders cite a five-year, $700 million total valuation. For context, ESPN’s current arrangement cost roughly $90 million annually. That’s a 50 percent jump — illustrating how hot F1’s U.S. rights have become as viewership surges.

apple’s strategy: from sports to experiences

Apple’s approach to live sports is distinct from traditional networks. The company isn’t chasing broadcast ratings; it’s curating brand alignment and ecosystem growth. After experimenting with MLB Friday Night Baseball and rolling out the MLS Season Pass, F1 is Apple’s next global trophy.

Through F1, Apple gains a multi-demographic audience — spanning affluent fans, global travelers, and younger viewers attracted by Netflix’s Drive to Survive. The synergy is clear: Apple gets event-driven engagement across devices, while F1 gains a technology partner known for immersive experiences.

Expect deeper integration with Apple’s platforms — live timing widgets, Vision Pro augmented-reality features, Apple Music soundtracks, even driver-fitness tie-ins on Fitness +. This isn’t just sports coverage; it’s an ecosystem play designed to keep fans inside Apple’s world.

formula one’s american dream

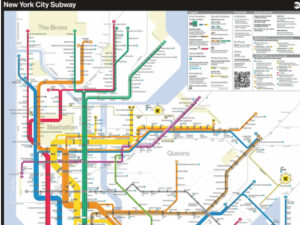

For F1, this partnership signals a new chapter in its U.S. expansion. The championship has added three American Grands Prix (Austin, Miami, Las Vegas), seen record attendance, and captured younger fans through digital storytelling.

Apple’s infrastructure allows F1 to offer a richer product to that growing fanbase. Through multi-camera feeds, real-time telemetry, and exclusive docu-style content, F1 aims to make the live-race experience more interactive and data-driven.

“We’ve seen extraordinary growth in the U.S.,” said Stefano Domenicali, F1 CEO, in the official announcement. “Apple’s innovation and global reach make them the ideal partner to deliver a new era of Formula One viewing.”

The timing is strategic: new car regulations debut in 2026, promising closer racing and sustainability improvements — a symbolic reboot for both the sport and its broadcast identity.

the end of an era for ESPN

ESPN’s six-year run with F1 helped rebuild the sport’s American presence, often simulcasting Sky Sports’ U.K. feed. The network achieved record ratings during marquee events like Las Vegas 2023 and Miami 2024, but escalating rights costs made renewal impractical.

In the streaming-first landscape, Disney’s ESPN is refocusing on bundled strategies (Disney+, Hulu, ESPN+), leaving room for Apple to outbid them. For F1 fans accustomed to ESPN’s accessible coverage, however, this transition raises concerns about cost and accessibility.

Where ESPN was part of many cable packages, Apple’s exclusivity means even casual viewers will need to migrate to a subscription service. Although Apple plans limited free access, the overall trend mirrors what’s happening across live sports: the end of “free TV” and the rise of platform silos.

implications

For fans, the Apple era brings both excitement and uncertainty. On one hand, Apple’s production quality and user experience could revolutionize race coverage. On the other, exclusivity risks alienating viewers unwilling to subscribe or switch platforms.

Apple promises “next-generation streaming performance” with multiple viewing modes — from onboard cameras to split-screen pit-lane analysis — all in native 4K. Yet live-sports streaming comes with technical pitfalls: latency, buffering, and regional blackouts.

Accessibility will be a test. The Apple TV app is available on most smart TVs and streaming sticks, but optimal performance may remain within Apple’s ecosystem. Meanwhile, F1’s own F1 TV Pro subscription complicates the landscape — whether it will coexist or merge with Apple’s offering remains unclear.

the streaming arms race

The deal underscores how major technology firms are weaponizing sports rights to fuel subscriber growth. Amazon’s NFL Thursday Night Football and Peacock’s Olympic coverage have proven the power of exclusivity. Apple now joins that elite club — betting that F1’s high-octane glamour will attract and retain users.

For F1, Apple’s brand association provides prestige and access to cutting-edge distribution. For Apple, live sports offer “appointment viewing,” countering subscription churn and boosting ad potential. Expect Apple to experiment with sponsorship integrations and interactive advertising, blending live sport with commerce.

Industry analysts view the $140 million annual price tag as a calculated investment rather than a profit play — a marketing strategy to elevate Apple TV + into the same conversation as Netflix, Amazon Prime Video, and Disney+.

the bigger picture

Symbolically, this partnership represents the convergence of performance and precision — Apple’s brand ethos aligns neatly with F1’s engineering culture. Both companies obsess over design, data, and experience.

It’s also a statement of how the media landscape is evolving: tech companies aren’t just distributing entertainment; they’re defining how we consume it. F1’s move from cable to streaming reflects the same paradigm shift that reshaped music, film, and news.

For Apple, the deal cements its identity as a media company, not just a hardware maker. For F1, it’s an entry ticket into the next phase of digital globalization — one powered by immersive technologies, predictive analytics, and direct-to-consumer storytelling.

impression

When the 2026 season lights go out, so too will the old model of U.S. F1 broadcasting. Apple TV will deliver the sport in a fully controlled digital ecosystem — sleek, data-driven, and on-demand.

Whether this becomes a model for other sports or a cautionary tale depends on execution. If Apple can merge cinematic production with real-time performance — and maintain accessibility — it may redefine live sports streaming.

In F1’s relentless pursuit of milliseconds, Apple’s precision may prove the perfect match. For fans, the next era of racing will unfold not on cable, but on the world’s most tightly curated screen.

No comments yet.