When Jensen Huang, the charismatic co-founder and CEO of Nvidia, sells a slice of his stock, the world notices. And when that slice is worth more than $36 million, it’s not just a corporate footnote — it’s a cultural and economic milestone that speaks volumes about the era we’re entering: the age of artificial intelligence-fueled fortunes.

This latest stock sale isn’t Huang’s first, nor will it be his last. But it carries particular symbolism today as his net worth inches closer to the legendary investor Warren Buffett. Long hailed as the “Oracle of Omaha,” Buffett represents the traditional, cautious approach to wealth — patient, methodical, value-oriented. Huang, in contrast, embodies the audacious, risk-tolerant spirit of tech, riding the tsunami of AI hype and hardware dominance.

The Numbers Behind the Sale

In early July 2025, filings revealed that Huang sold over 600,000 shares, netting around $36 million. Even after taxes and adjustments, it’s a hefty payday by any standard. But to Huang, whose total net worth has soared past $115 billion, it’s a relatively small dip into an ocean of wealth.

This transaction is part of a larger pattern. Executives often sell shares for tax planning, diversification, or personal liquidity. But in Huang’s case, it’s also a public signal of confidence and strategic maneuvering. Despite these sales, he still owns an enormous stake in Nvidia, whose valuation continues to rocket.

The Meteoric Rise of Nvidia

Nvidia began in 1993 as a niche company making graphics processing units (GPUs) for gamers. While its gaming division remains lucrative, the company’s focus shifted dramatically over the past decade toward AI, data centers, and high-performance computing. GPUs are now the backbone of machine learning, enabling everything from ChatGPT-like language models to autonomous vehicle simulations.

In 2016, Nvidia’s stock price hovered around $30. By mid-2025, it surged past $1,250 per share. This growth catapulted Nvidia into the elite club of trillion-dollar companies, alongside Apple, Microsoft, and a handful of others. Huang’s stake, once considered a modest founder’s nest egg, has transformed into one of the largest individual fortunes on the planet.

The Buffett Benchmark

Warren Buffett, born in 1930, built Berkshire Hathaway into an empire through slow, steady investments in insurance, railroads, utilities, and blue-chip stocks. His disciplined approach won him a dedicated following and decades atop the billionaire lists. At its peak in 2022, Buffett’s net worth touched around $120 billion.

Yet Buffett’s portfolio philosophy is conservative by design. In an era where tech valuations can triple in a year, his wealth has become relatively static. Meanwhile, Huang’s fortune, buoyed by Nvidia’s AI boom, has doubled — and then some — in just the last three years.

Comparing Huang to Buffett isn’t merely about numbers; it’s a metaphor for the shift in economic power from industrial-age moguls to digital-age architects. Buffett’s Coca-Cola shares symbolize an America that once was, while Huang’s semiconductor empire represents what’s next.

Cash Out or Confidence Move?

Skeptics often interpret executive stock sales as a lack of faith in future prospects. However, seasoned observers note that most high-profile CEOs, from Elon Musk to Jeff Bezos, have periodically liquidated shares for a variety of reasons: funding new ventures, philanthropy, or simply portfolio diversification.

Huang, who lives relatively modestly compared to some Silicon Valley peers, is known for his deliberate decisions. He built Nvidia over decades, weathering crises and pivoting strategically. Analysts believe his latest sale doesn’t signal a top for Nvidia but rather represents prudent wealth management.

Nvidia’s Central Role in the AI Revolution

While OpenAI, Anthropic, and countless startups grab headlines for software breakthroughs, they all share one dependency: Nvidia’s hardware. The company’s GPUs power nearly every large AI model on Earth. In data centers worldwide, racks of Nvidia chips churn through calculations at unfathomable speeds, pushing AI’s boundaries.

The recent release of Nvidia’s Blackwell GPU architecture further solidified its lead. Blackwell chips deliver unprecedented performance gains, slashing training costs and timelines for massive AI models. This technological leap is one reason why Nvidia’s stock keeps climbing — and why Huang’s fortune keeps ballooning.

The “New Oil”: Semiconductors and AI Chips

For decades, oil was the most critical strategic resource, shaping geopolitics and fortunes alike. Today, many argue semiconductors have taken that crown. Chips are the invisible engines of our smartphones, cars, factories, and now, AI systems.

Nvidia sits at the epicenter of this new paradigm. The company’s chips are as vital to AI researchers as oil is to economies. As governments, from Washington to Beijing, scramble to secure chip supplies, Nvidia’s dominance has turned it into an indispensable player — and Huang into a kind of digital oil baron.

Huang’s Personal Brand and Leadership Style

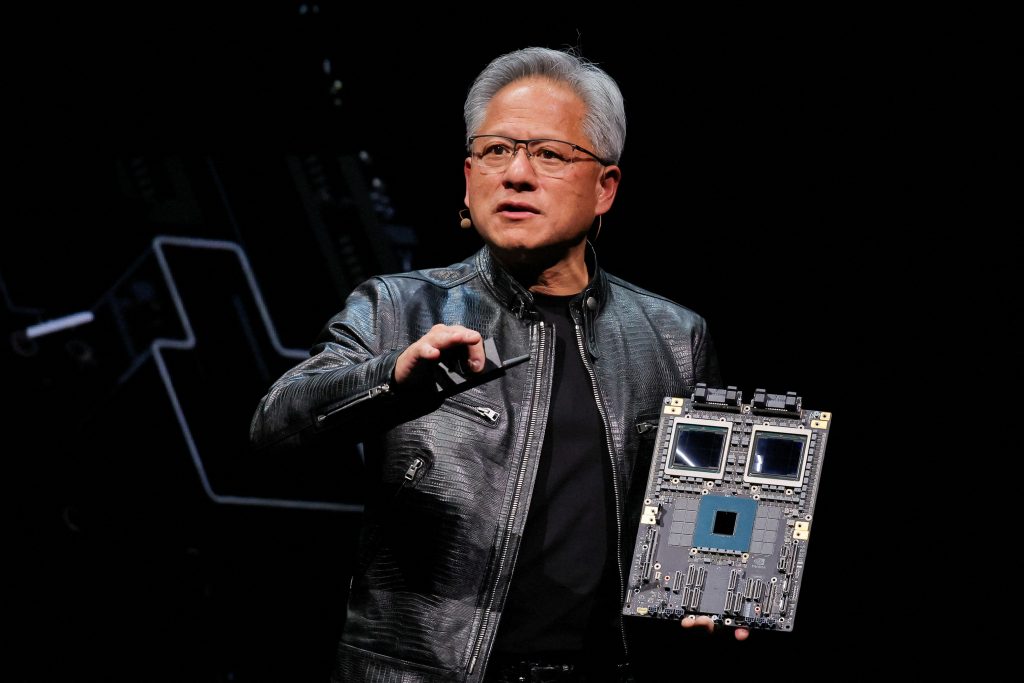

Unlike some tech CEOs who crave the spotlight, Huang remains both charismatic and enigmatic. His trademark leather jacket has become a symbol of both his individual style and Nvidia’s culture: sleek, confident, and forward-looking.

Huang’s approach to leadership contrasts with traditional corporate leaders. He doesn’t merely delegate; he immerses himself in technical details, product roadmaps, and long-term strategy. Insiders describe him as both a demanding visionary and a relentless perfectionist — traits that have guided Nvidia from a niche chipmaker to a global powerhouse.

Philanthropy and Future Plans

So far, Huang hasn’t indicated Buffett-level philanthropic commitments (like the Giving Pledge), but he’s signaled interest in supporting education and research, particularly in AI and computer science. As his net worth edges closer to Buffett’s, many watchers expect him to outline broader philanthropic visions.

It’s not uncommon for ultra-wealthy tech figures to evolve into philanthropists in the latter half of their careers. Bill Gates famously shifted focus to global health, while Bezos has ramped up Earth-focused initiatives. Whether Huang will take a similar route remains an open question.

Stock Sales in Context: The Bigger Picture

Executive stock sales are often scrutinized with a magnifying glass, yet they remain a normal part of wealth management. Diversification, tax optimization, and estate planning often necessitate these sales, even when insiders remain optimistic about their companies.

Huang’s $36 million sale is a drop in the ocean compared to his total holdings, estimated at over $90 billion in Nvidia shares alone. His remaining stake ensures his interests are deeply aligned with Nvidia’s long-term performance.

Moreover, as Nvidia’s valuation continues to surge, expect to see more periodic sales from Huang. This is both logical and strategic, particularly if he begins channeling wealth into other ventures or causes.

AI’s Impact on the Billionaire Rankings

Huang’s rise is emblematic of a broader trend: AI is minting a new wave of billionaires. Sam Altman (OpenAI), Dario Amodei (Anthropic), and other founders in AI hardware and software have rapidly amassed significant wealth, reflecting investor optimism and speculative enthusiasm.

Yet Huang’s position is unique. Unlike most AI entrepreneurs who depend on venture funding and IPOs, Huang commands an industrial juggernaut generating massive profits today. Nvidia isn’t just a bet on future AI potential — it’s an indispensable foundation for current AI infrastructure.

As AI reshapes industries from healthcare to finance, those controlling the tools and compute resources stand to gain the most. It’s a transformation reminiscent of the early internet age but on steroids.

Closing In on Buffett: Symbolism Over Substance

The fact that Huang is nearing Buffett in net worth resonates beyond dollar signs. It marks a changing of the guard, a symbolic handover from value investing’s quiet wisdom to the explosive growth and optimism of tech.

Buffett, who famously avoided tech stocks for most of his career (apart from a late embrace of Apple), represents a bygone era. Huang, the embodiment of semiconductor supremacy and AI fervor, stands as a beacon for where capital, talent, and ambition are headed.

Some might view this shift with nostalgia or even unease, given the volatility of tech valuations. Others see it as inevitable — a natural progression as our economy pivots from atoms to bits, from railroads to neural networks.

What’s Next for Nvidia and Huang?

Nvidia’s roadmap shows no signs of slowing down. New generations of AI-focused GPUs, expansions into robotics and edge computing, and breakthroughs in AI training efficiency are all on the horizon.

For Huang personally, the challenge is to sustain Nvidia’s momentum without succumbing to complacency or external shocks. Geopolitical tensions, supply chain vulnerabilities, and intensifying competition (from AMD, Intel, and emerging Chinese rivals) could all pose threats.

Nevertheless, Nvidia’s lead in software ecosystems (CUDA, for example) and deep relationships with hyperscalers (Amazon, Microsoft, Google) provide formidable moats.

Final Thoughts: A Billionaire for the AI Age

Jensen Huang’s $36 million stock sale is far more than a liquidity event. It’s a headline encapsulating a seismic shift in the global economy: the rise of AI, the centrality of semiconductors, and the ascendancy of new tech leaders whose fortunes rival — and in some cases eclipse — the titans of old.

Whether Huang overtakes Buffett in net worth permanently is less important than what it symbolizes: the dawn of a new industrial revolution, powered not by steel and railroads but by silicon and algorithms.

As AI continues to penetrate every corner of society, expect Huang and his contemporaries to dominate not just wealth rankings but the narratives that shape our collective future.

No comments yet.