“Vibecession,” a term coined to describe the growing disconnect between the economy and public perception, has become a hot topic as individuals turn to pop culture, like Lady Gaga’s latest album or Will Smith’s return to music, as harbingers of impending financial doom. Despite relatively healthy economic data, this pervasive sense of unease has economists worried about the potential consequences of a self-fulfilling prophecy.

Consumer Sentiment vs. Economic Indicators

Recent months have seen consumer sentiment drop significantly, reaching its lowest point since 2020, while Google searches for “recession” spike. This anxiety manifests as people scrutinize current events and cultural trends, interpreting them as signs of an impending downturn. However, many traditional economic indicators, such as employment numbers and manufacturing output, remain stable, creating a discrepancy between perception and reality.

Impact on Spending and Market Risk

As consumer sentiment declines, people may become more cautious with their spending, potentially impacting retail sales and overall economic growth. Additionally, a majority of fund managers view a trade war-induced global recession as a significant market risk. Despite this, hard economic data suggests a relatively stable economy, particularly in the job market.

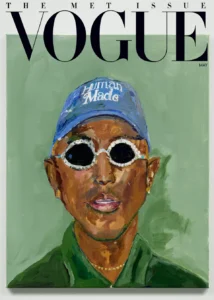

The Role of Pop Culture

Pop culture often acts as a mirror, reflecting societal concerns and anxieties. The return of familiar cultural touchstones from the 2008 recession era could subconsciously trigger fears of history repeating itself. As vibecession permeates online discourse, these fears may intensify, creating a negative feedback loop that could undermine economic stability.

Final Thoughts

While economic data indicates a relatively healthy market, the phenomenon of vibecession highlights the powerful influence of public sentiment on economic outcomes. As consumer anxiety rises, economists must grapple with the challenge of addressing these concerns and mitigating their potential impression on the broader economy. Understanding and navigating the disconnect between perception and reality will be crucial in fostering a stable and prosperous future.

No comments yet.